Quick Takeaways:

- Pi Network price has dropped to its lowest level since early November.

- A double-top chart pattern signals potential further downside.

- Rising token unlocks and weak trading volume continue to pressure demand.

Pi Network price continued its decline on December 14, extending a weak trend seen throughout the month. The token fell to $0.085, marking its lowest level since November 4.

The drop erased most gains from last month’s rally. During that period, Pi briefly outperformed major assets like Bitcoin and Ethereum.

The recent sell-off reflects fading demand and growing supply concerns. Market sentiment around Pi Network has turned increasingly cautious.

Token Unlocks Weigh Heavily on Market Sentiment

One major factor driving Pi’s decline is its expanding token supply. Pi Network is unlocking more than 190 million tokens this month alone.

Over the next 12 months, total unlocks are expected to reach 1.2 billion tokens. That steady supply increase adds persistent pressure on price action.

There is some relief ahead. Developers say the pace of unlocks should slow over the next six months.

Still, current conditions remain challenging. Investors often react negatively when new tokens enter circulation faster than demand grows.

Weak Trading Volume Signals Fading Investor Interest

Falling demand has become more visible in trading data. According to CoinMarketCap figures, Pi’s 24-hour volume dropped to about $9.5 million.

That figure is low for a token with a market capitalization near $2 billion. Low volume often signals hesitation among traders and long-term holders.

This trend suggests buyers remain on the sidelines. Without fresh demand, price recovery becomes difficult.

The muted activity also raises liquidity concerns. Thin trading conditions can amplify price swings during sell-offs.

Network Developments Fail to Lift the Token

Pi Network’s decline comes despite several ecosystem updates. Developers recently announced the winners of a community hackathon.

The event aimed to encourage app development and ecosystem growth. So far, the impact on token demand appears limited.

The project also invested in CiDi Games. That move signals ambitions to expand into the gaming sector.

Additionally, Pi Network has increased its focus on artificial intelligence. It has invested in OpenMind, a company operating in the AI space.

Developers say AI tools now support KYC processing and network efficiency. Automation has helped address validator shortages and reduce manual reviews.

Despite these efforts, the market response remains muted. Investors appear focused on supply growth and price structure instead.

Technical Analysis Points to a Bearish Setup

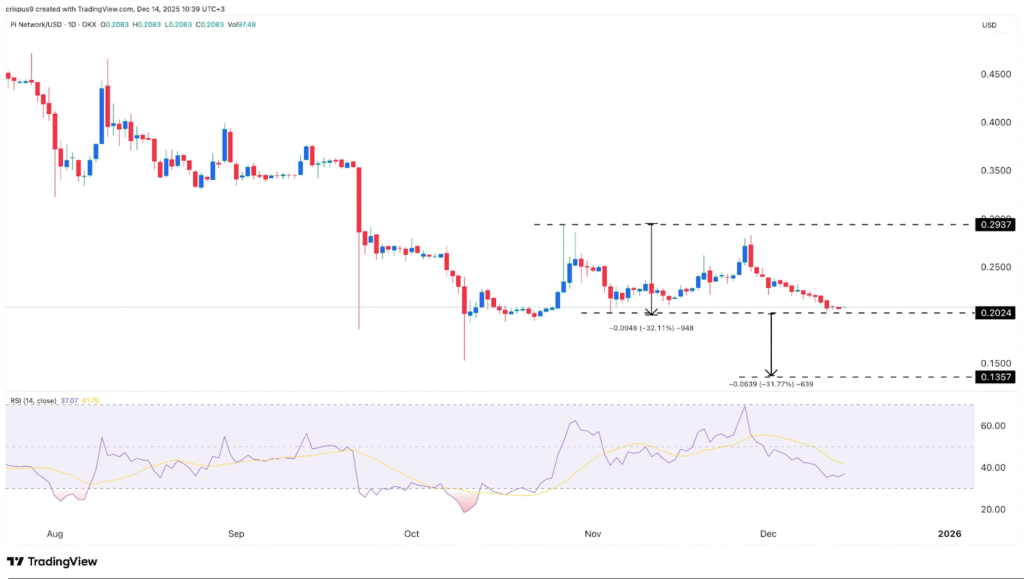

Technical indicators paint a concerning picture for Pi Network price. The daily chart shows a clear double-top pattern forming near $0.2937.

This pattern often signals a potential trend reversal. The price is now approaching the neckline around $0.205.

Using standard technical measurements, the setup implies further downside. A breakdown could send Pi toward $0.1357 in the near term.

Momentum indicators support the bearish outlook. The Relative Strength Index continues to slope downward.

Pi remains below all major moving averages. It also trades under the Supertrend indicator.

These signals suggest sellers still control the market. A trend shift would require a decisive move above resistance levels.

Market Outlook Remains Fragile

In the short term, Pi Network faces several headwinds. Token unlocks continue to expand supply faster than demand.

Trading volume remains weak. Technical indicators point to further downside risk.

Long-term, the project’s ecosystem efforts may support recovery. Growth in gaming and AI use cases could attract renewed interest.

However, timing remains uncertain. Markets often demand clear utility and strong adoption signals.

For now, Pi Network price action reflects caution rather than optimism. Traders will watch support levels closely in the coming weeks.

A sustained bounce would require rising volume and improving sentiment. Until then, the bearish structure remains intact.