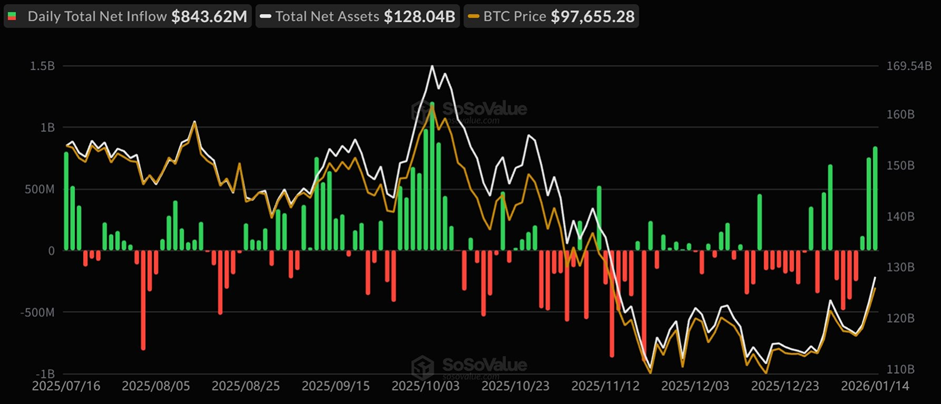

- U.S. spot Bitcoin ETFs recorded $844 million in net inflows on Jan. 14, led by BlackRock’s IBIT.

- Ethereum, Solana, and XRP spot ETFs posted positive inflows,a signal of high institutional participation.

- ETF inflows occurred during price consolidation and this is reflecting structured allocation.

U.S. spot Bitcoin ETFs marked a decisive return of institutional capital on Jan. 14 (ET). SoSoValue data showed total net inflows reached $844 million in a single trading session.

The scale of buying placed the day among the strongest inflow periods since spot ETF approvals. Institutional investors increased exposure as Bitcoin traded within a stable range.

Rather than reacting to sharp price gains, allocators entered during consolidation. This behavior reflects disciplined portfolio positioning common across traditional asset markets.

Total net assets across U.S. spot Bitcoin ETFs now stand near $128.04 billion. Cumulative inflows have reached approximately $58.12 billion.

These holdings represent about 6.56% of Bitcoin’s market capitalization, underlining the growing importance of ETFs in crypto market structure.

BlackRock IBIT Leads U.S. Spot Bitcoin ETFs Inflows

BlackRock’s spot Bitcoin ETF, IBIT, captured the largest share of inflows on Jan. 14. The fund recorded $648 million in net inflows, accounting for most of the daily total.

Source: X

This performance further widened the gap between IBIT and competing products. Large asset managers continue to favor IBIT due to its liquidity and operational scale.

The ETF benefits from BlackRock’s established compliance and custody standards. These features appeal to pensions, registered investment advisors, and large family offices.

IBIT now holds approximately $76.19 billion in assets under management. Its rapid growth reflects trust in established issuers offering regulated crypto exposure.

The concentration of inflows suggests institutions prefer a single primary vehicle for Bitcoin allocation.

Ethereum and Altcoin ETFs Attract Steady Capital

Ethereum spot ETFs also recorded strong activity during the same session. According to SoSoValue, these products posted $175 million in net inflows.

The demand confirms Ethereum’s role as a core institutional asset alongside Bitcoin. Ethereum ETF inflows arrived without sharp price acceleration.

Source: X

This pattern suggests investors view ETH as a strategic holding rather than a short-term trade. Smart contract adoption and network stability continue to support its institutional appeal.

Altcoin ETFs also saw positive, though smaller, inflows. Solana spot ETFs added $23.57 million, while XRP spot ETFs recorded $10.63 million.

These figures show measured interest in diversified crypto exposure through regulated structures.

ETF Inflows Reflect Structured Institutional Allocation

The timing of ETF inflows offers insight into investor behavior. Capital entered U.S. spot Bitcoin ETFs during consolidation rather than euphoric rallies.

This approach aligns with long-term portfolio construction strategies. Green inflow metrics across ETF dashboards suggest that buying activity supported market stability.

Inflows appeared to reinforce price levels instead of reacting to volatility. This pattern differs from earlier cycles driven by retail speculation.

Broader crypto markets reflect similar trends. Public companies continue to hold large Bitcoin reserves, while venture capital targets infrastructure and security projects.

Together, these developments point to a more mature allocation environment. U.S. spot Bitcoin ETFs remain central to this shift.

Their regulated structure lowers operational barriers for institutional investors. As assets grow, ETFs continue to shape liquidity and participation across crypto markets.

The Jan. 14 inflow data highlights sustained institutional engagement. U.S. spot Bitcoin ETFs demonstrated strong demand across multiple assets by recording 844 million dollar inflows. These signals continued confidence in regulated crypto exposure.