Quick Takeaways

- Grayscale announces the first staking payout tied to a US-listed smear Ethereum ETF.

- ETHE shareholders will receive about $0.08 per share from converted staking rewards.

- The move may accelerate SEC decisions on staking for other spot Ether ETFs.

Grayscale has directed a turning point for US-listed crypto investment products. The business firm declared its first-ever Ethereum staking payout for a central-deal fund.

The distribution strikes off the first metre, a US-heel spot crypto ETP has issued cash proceeds from-chain in hazard rewards. Presents a milestone for both Ethereum and regulated crypto investing.

According to a Monday press release, shareholders of the Grayscale Ethereum Trust ETF will receive the payout this week. The distribution stems from Ethereum staking rewards earned after October.

Details of the Staking Distribution

Grayscale said ETHE shareholders will receive roughly $0.08 per share. The payout will be made in cash, not Ether. The distribution is scheduled for Tuesday. Eligibility is based on holdings recorded at the market close on Monday.

Staking rewards were generated after Grayscale enabled Ethereum staking on Oct. 6. The firm conducts staking through institutional custodians and third-party validators. Rather than distributing rewards in ETH, Grayscale converts them into dollars. This structure aligns with traditional expectations for ETF income.

ETH shares were trading approximately 2% higher in the early Monday session. Market data from Yahoo Finance reflected modest investor optimism.

Why Grayscale Can Offer Staking

Grayscale’s Ethereum funds operate outside the Investment Company Act of 1940. This regulatory structure differs from most traditional US ETFs. Operating outside the 1940 Act allows Grayscale to enable staking. However, it also means different regulatory protections for investors.

The firm activated staking for both ETH and the Ethereum Mini Trust ETF. These products became the first US-listed spot Ether ETPs with staking exposure. Staking plays a central role in Ethereum’s proof-of-stake model. It helps validate transactions and secure the network.

In return, validators earn periodic rewards. Grayscale captures these rewards on behalf of shareholders.

Pressure Builds on Regulators

Grayscale is currently alone in offering staking payouts among US-traded Ether ETFs. But that exclusivity may not last. Several major asset managers are seeking regulatory approval to add staking. The filings reflect rising demand for yield-bearing crypto products.

In March, Cboe BZX filed a rule change proposal for Fidelity’s Ethereum Fund. The request would allow the fund to stake some or all of its Ether. A similar proposal followed for the 21Shares Core Ethereum ETF. Both filings await review by the US Securities and Exchange Commission.

BlackRock has also signaled interest. In November, it registered a staked Ethereum ETF in Delaware. That registration is an early procedural step. BlackRock’s existing iShares Ethereum Trust ETF does not currently stake assets.

Spot Ether ETFs Enter a New Phase

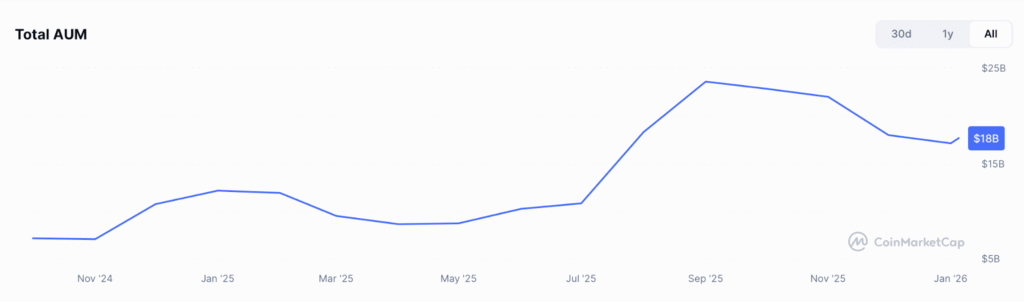

US spot Ether ETFs launched in July 2024. This makes 2025 the first full year they have traded. During the year, the products attracted strong investor interest. Net inflows reached approximately $9.6 billion.

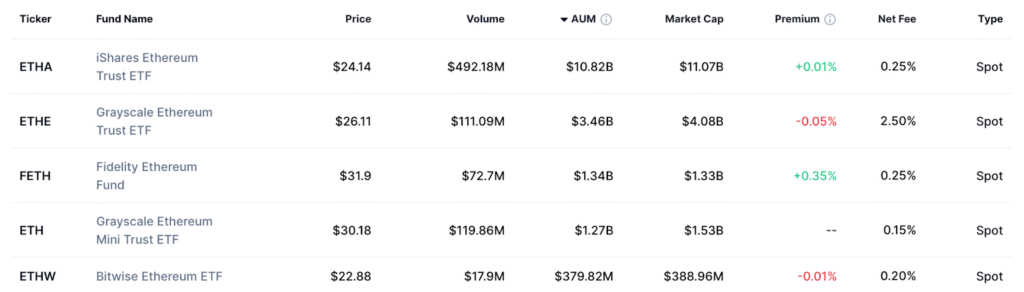

According to CoinMarketCap, US spot Ether ETFs now manage about $18 billion. BlackRock’s ETHA leads the group with roughly $11.1 billion in assets. Grayscale’s ETHE follows with around $4.1 billion. The Ethereum Mini Trust ETF holds about $1.5 billion.

Staking could reshape competition among these funds. Yield may become a key differentiator for investors. Grayscale’s payout sets a precedent. It demonstrates that regulated products can bridge on-chain activity and traditional finance.

As regulators weigh future approvals, the pressure is mounting. Ethereum staking may soon become standard for US-listed Ether ETFs.