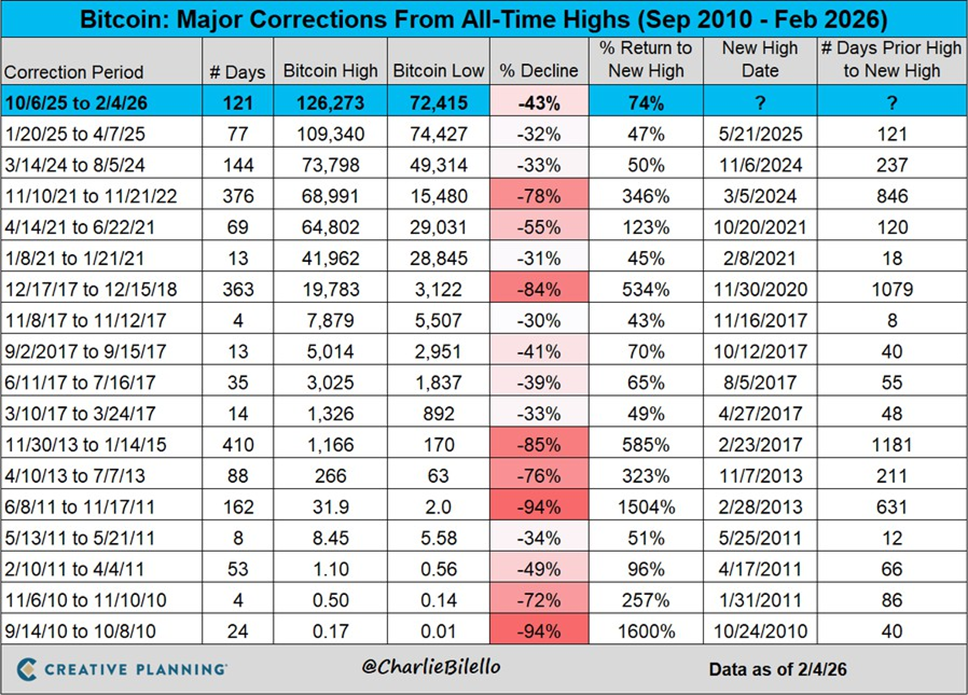

- Bitcoin drops 43%, signaling a significant market correction.

- Solana faces a 15.59% decline driven by market-wide sell-offs.

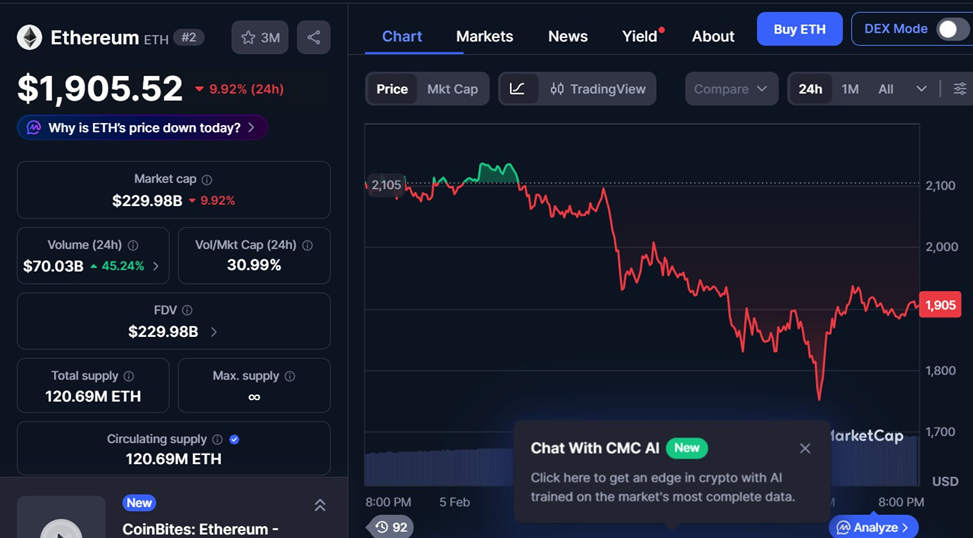

- Ethereum sees a 9.92% dip as selling pressure continues to rise.

The crypto market is experiencing a significant downturn, with Bitcoin (BTC), Solana (SOL), and Ethereum (ETH) facing major price corrections. Bitcoin is currently down by 43% today, marking its largest decline since 2022 and the largest decline ever recorded for Bitcoin. Other cryptos like Solana and Ethereum are also declining sharply.

Source| X

Bitcoin Faces Major Correction and Dips Below $65K

Bitcoin is undergoing a significant correction, with its price dropping sharply from recent highs. The recent sell-offs by large players like Donald Trump, who sold $5,050,000 in Bitcoin, and the Royal Government of Bhutan, which sold another 184 BTC, have added substantial downward pressure to the market. These selling pressures have exacerbated the current crash.

If Bitcoin fails to maintain support at the $58K level, it could continue its downward trend, with the next potential target range being $43,850 – $47,712, aligning with a weekly Fair Value Gap. Although short-term reversal indicators are present in the lower time frames (LTF), the overall market remains weak.

Source| X

The Bitcoin price has dropped to $64,940, a 8.21% decrease over the last 24 hours. The volume growth of 87.81% signifies that the company is highly traded, meaning that there is high selling pressure. If Bitcoin fails to find support in the $64K-$65K range, further declines are likely.

Bloomberg Analyst Warns on Bitcoin Dip to $10,000

A senior Analyst at Bloomberg Intelligence, Mike McGlone, has issued a warning that Bitcoin may face a severe collapse toward $10,000 as global markets show signs of stress reminiscent of past financial crises. In early February 2026, McGlone compared the current market conditions to the 2008 financial crisis and the 2000–2001 dot-com downturn.

McGlone warns that Bitcoin is increasingly exposed to broader macroeconomic stress. Tighter liquidity, slowing growth, and the unwinding of years of speculation are weighing on markets. With inflation easing and central banks pulling back support, volatility is rising, putting risk assets like Bitcoin under pressure.

Price Shift with Derivatives and Synthetic Supply

The ongoing crypto crash isn’t driven only by bad news or outside pressures. It also reflects a bigger structural shift in how Bitcoin and other cryptocurrencies are traded. As Bitcoin becomes more integrated into traditional financial markets, derivatives like cash-settled futures, perpetual swaps, and options now play a much larger role in driving price discovery.

Bitcoin’s price stopped reflecting pure market demand once synthetic assets began to overshadow the actual on-chain supply. Instead, Wall Street–driven positioning, hedging, and liquidation flows started to shape price movements. This shift effectively created unlimited “paper BTC,” now traded across a wide range of derivative products and leveraged positions. These synthetic assets are, in fact, driving the price of Bitcoin, not based on its scarcity but on its flow.

The result? The Synthetic Float Ratio (SFR) indicators show that the price of Bitcoin is no longer pegged to the actual supply and the market no longer operates based on conventional

supply-demand dynamics. This has established a price system of fractional-reserve that is similar to the functions of the traditional financial markets like oil or gold.

Solana Price Faces Sharp Decline

Similarly to Bitcoin, Solana (SOL) has fallen by a substantial margin too. Solana is currently trading at $77.32, which is 15.59% lower than the last 24 hours. Solana price started falling at a very high rate after reaching its peak at approximately $90.85. The 24-hour trading volume has risen 74.39% which is attributed to the increased activity on the market as traders exit the market.

Solana Trading Chart| Source: Coinmarketcap

The decline by Solana has been caused by various factors and the fact that traders are taking profit is one of the factors that have led the Solana to fall. Furthermore, the market collapse that has been experienced by the market has impacted the price of Solana as most of the altcoins are sensitive to the price movements of Bitcoin. The market cap of Solana has also experienced a considerable decline to reach 43.81 billion, which means that the investors have lost trust in the short-term perspective.

Ethereum Price Dips 10% as Selling Pressure Continue to surge

Ethereum (ETH) price on the other hand, is also seeing a down trend in the price, losing 9.92% in the last 24 hours, which has reduced its price to $1,905.52. The market cap has fallen by 9.92%, but trading volume has increased by 45.24%.

Ethereum Trading Chart| Source: Coinmarketcap

The price peaked at $2,105 before sharply dropping, indicating increased selling pressure. Similar to Bitcoin and Solana, Ethereum is entering a market correction; $1,800 could act as a key support level.