- Institutional investors reduced Bitcoin and Ethereum exposure as Federal Reserve rate cut expectations drifted further.

- Capital moved to altcoins, a sign that investors favored project-specific momentum.

- Outflows were concentrated in US-listed products, while European funds recorded steady inflows during the same period.

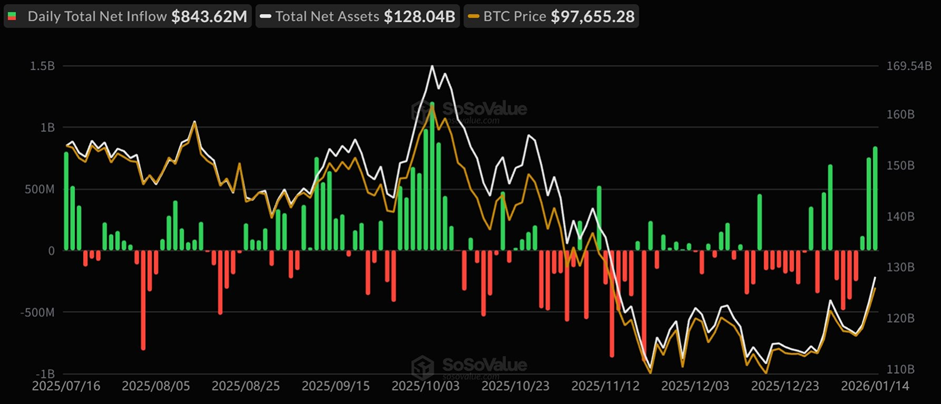

Digital asset investment flows recorded US $454 million in net outflows last week. This is reflecting a shift in investor sentiment as expectations for a March Federal Reserve rate cut softened.

Bitcoin Dominates Outflows as Fed Timing Shifts

Bitcoin accounted for US$405 million of last week’s total outflows, marking the largest single-asset reduction. Institutional investors are reducing exposure to macro-sensitive cryptocurrencies after expectations of a rate cut faded.

This indicates that this is a move away from short-term macro-driven positions and not a sell-off across the market. The second largest crypto Ethereum, also experienced withdrawals of US$116 million.

This reinforces that secondary assets are affected alongside Bitcoin. Investors appear cautious due to uncertain fee structures, Layer-2 adoption issues, and delayed network developments.

In turn this has led to broader reductions in major crypto holdings. Grayscale and Fidelity absorbed most outflows, while iShares gained US $181 million.

This shows that outflows are concentrated in specific products as investors consolidate into liquidity-preferred vehicles. Therefore investors are within the market.This is not a general market panic.

Altcoins See Inflows Amid Narrative-Driven Rotation

Top altcoins attracted capital, Solana gained US$32.8 million, XRP US$45.8 million, and Sui US$7.6 million.

This shows that investors are shifting toward projects with independent adoption potential and whose strategy is focused on catalysts.

Investors are targeting altcoins where development news or ecosystem activity can drive returns, regardless of the Federal Reserve decisions. These inflows were intentional, and are not random.

Investors are therefore reallocating toward assets where story-driven performance can outperform macro-sensitive holdings. This reflects a market adjusting to Fed timelines but still keeping capital in crypto.

Digital Asset Investment Flows Reflect Regional and Institutional Trends

US investors drove the majority of the outflows, recording US$568.9 million withdrawn. In contrast Germany and Switzerland absorbed US$58.9 million and US$21 million, respectively.

This indicates that outflows are a regional response to macro developments rather than global market exits. Notably, short Bitcoin positions only saw US$9.2 million inflows.

This suggests institutions were not betting on a market decline but actively reducing exposure. The data reflects careful positioning rather than fear-driven selling.

Provider-level flows further confirm strategic reallocations. iShares gained while Grayscale and Fidelity saw withdrawals, showing that capital is consolidating into preferred liquidity channels.

This indicates selective positioning as investors react to fading rate cut expectations. Digital asset investment outflows totalling to US$454 million exited crypto products last week.

Select altcoins attracted capital as investors prioritized narrative-driven opportunities. The data points to deliberate, US-based institutional repositioning rather than a broader market downturn.

Real-Time Data Signals Tactical Repositioning

The global crypto market cap stands at $3.17 trillion, down 0.8% in 24 hours.

Source: CoinGecko

In spite, trading volume is active near $98 billion. This figure confirms sustained participation.

Bitcoin is down 0.7 percent intraday extending its weekly fall to 2.7 percent and is being traded around $90,200. This trend suggests controlled macro-driven de-risking.

Ethereum follows closely near $3,078, and is reinforcing its correlation with broader risk sentiment. Below the surface, divergence is visible.

Solana is up 1.4% on the day and 3.3% on the week, aligning with recent inflows. XRP is down 3.6% weekly, despite institutional accumulation. Privacy coins trending signals speculative rotation. The picture from digital asset investment flows confirms a tactical market shift rather than broad risk aversion.